-

The Surprising Trend in the Number of Homes Coming onto the Market

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

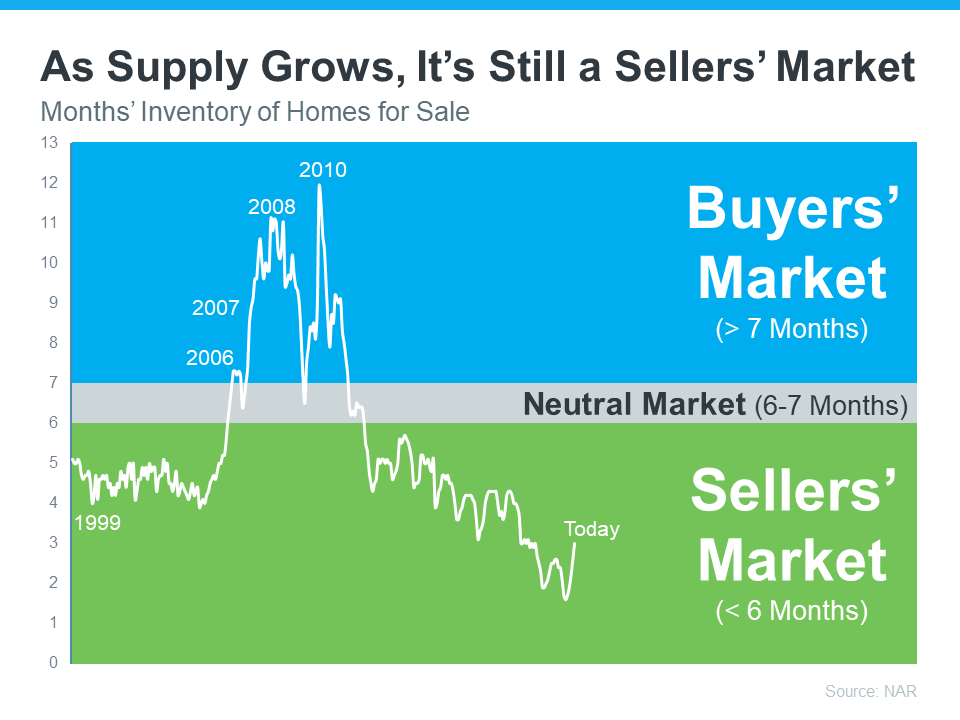

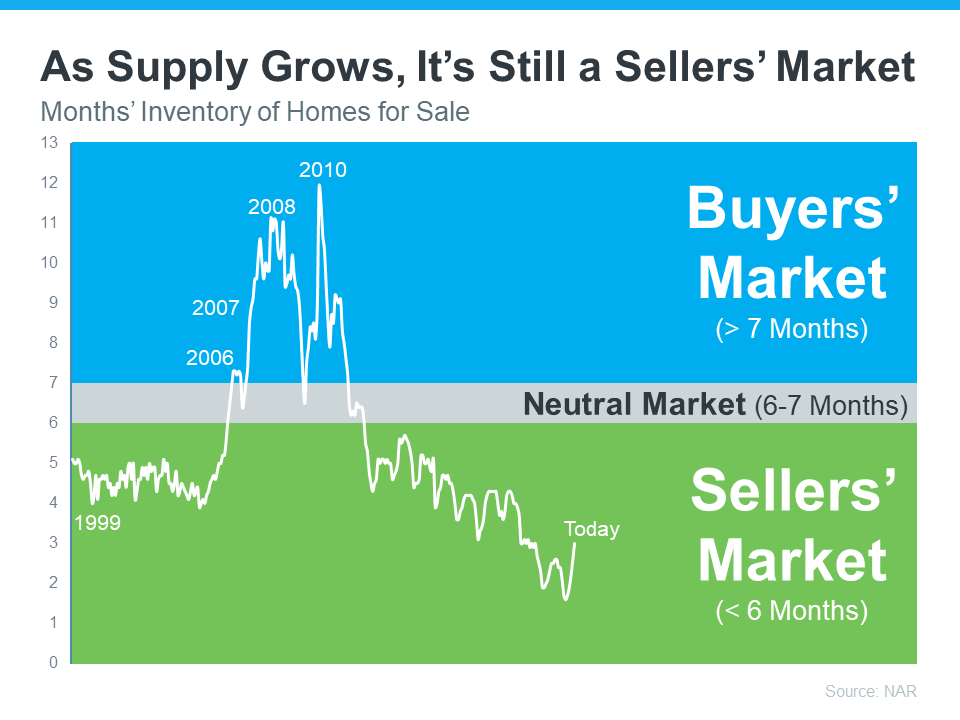

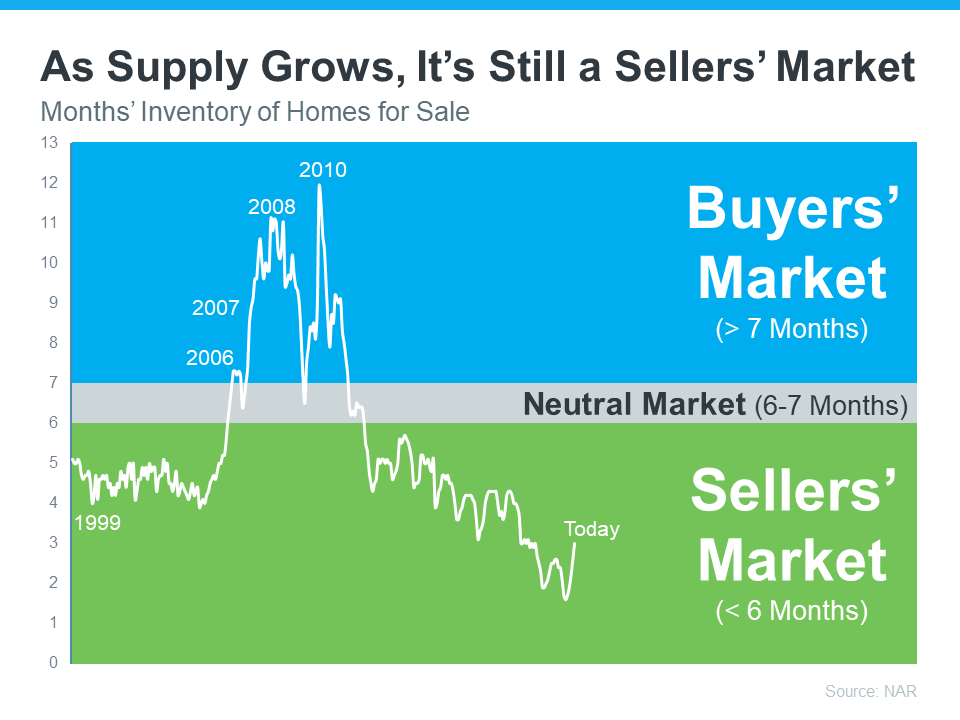

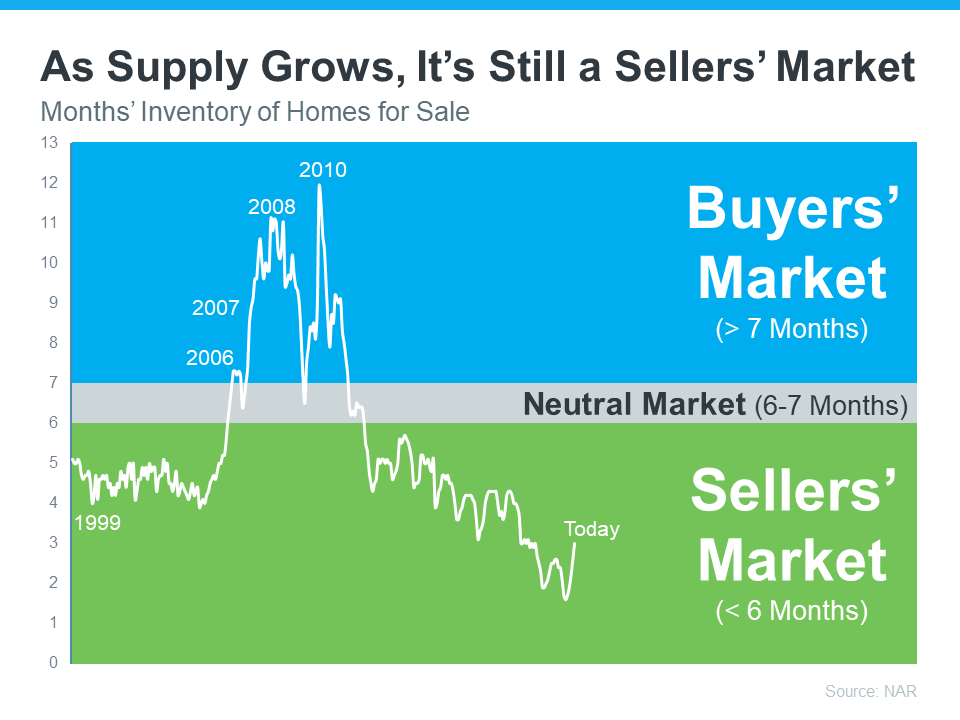

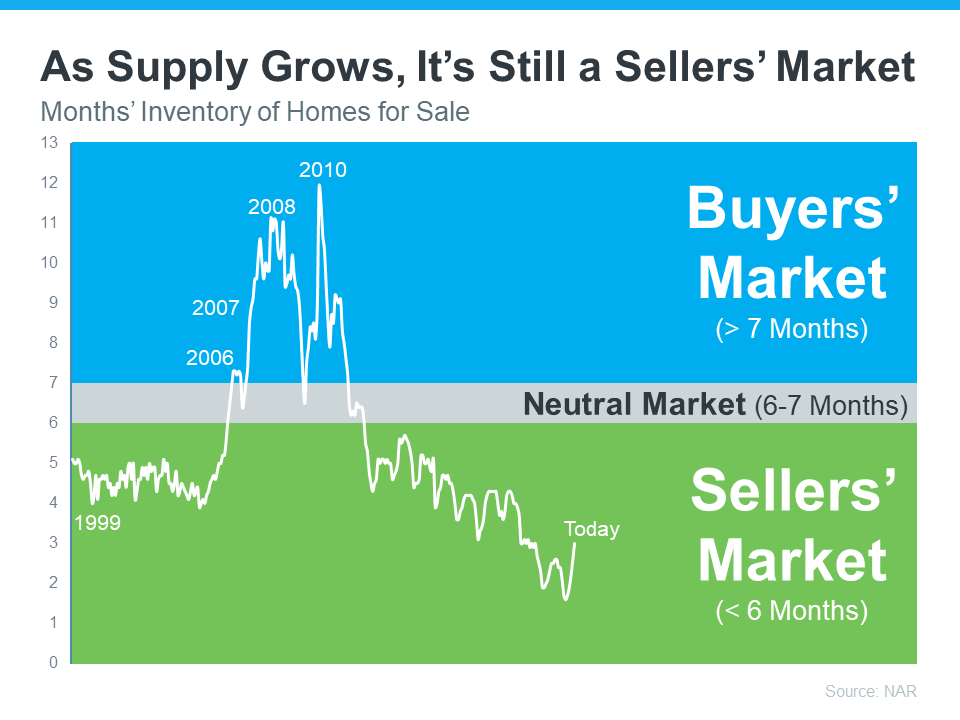

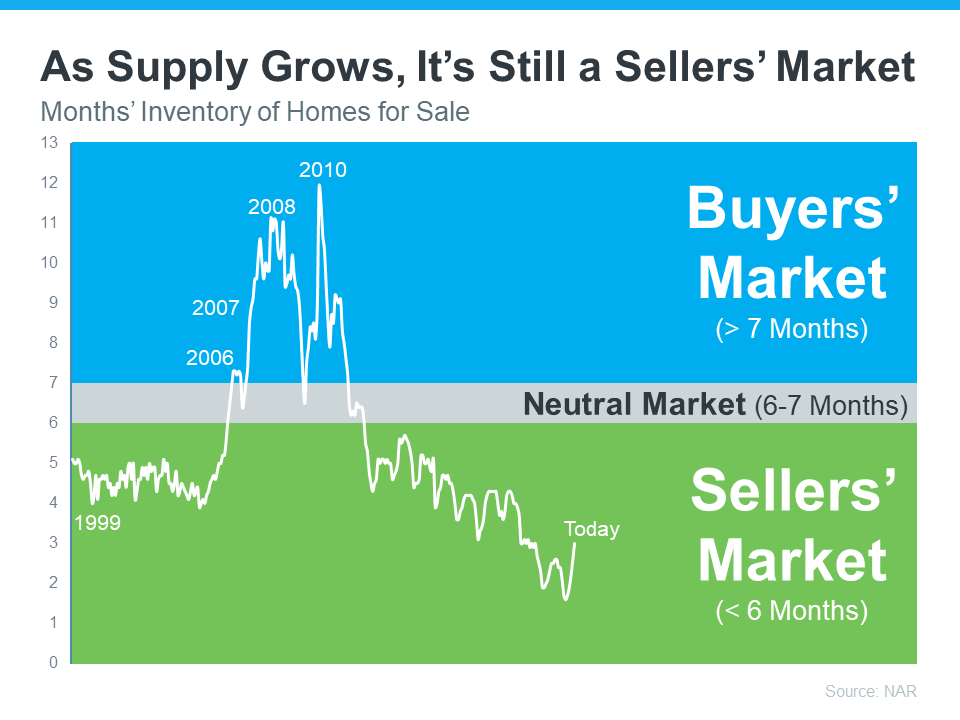

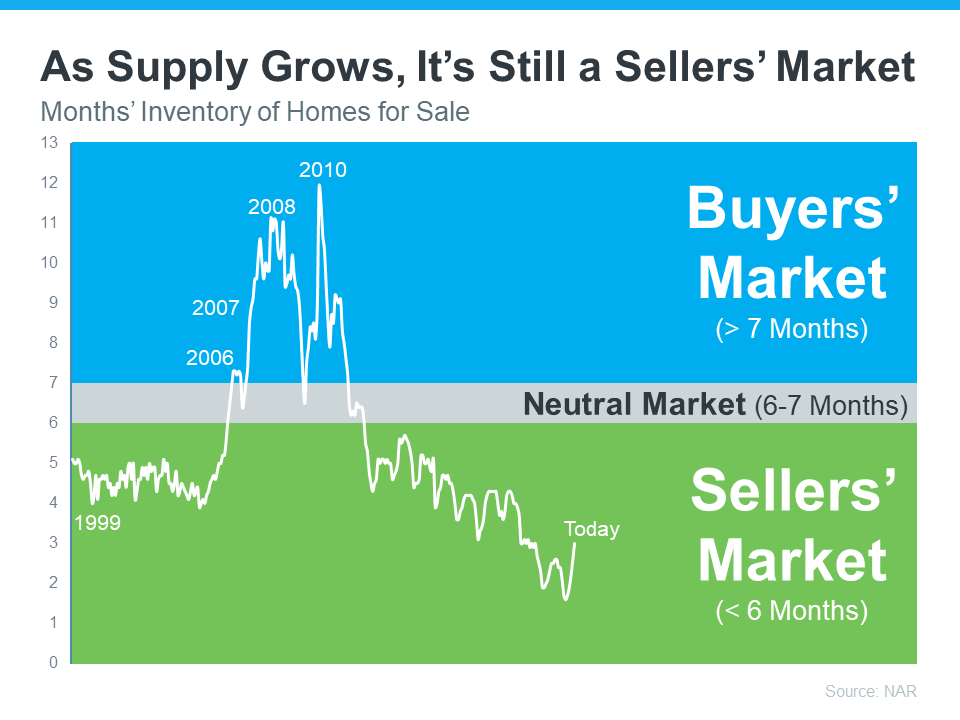

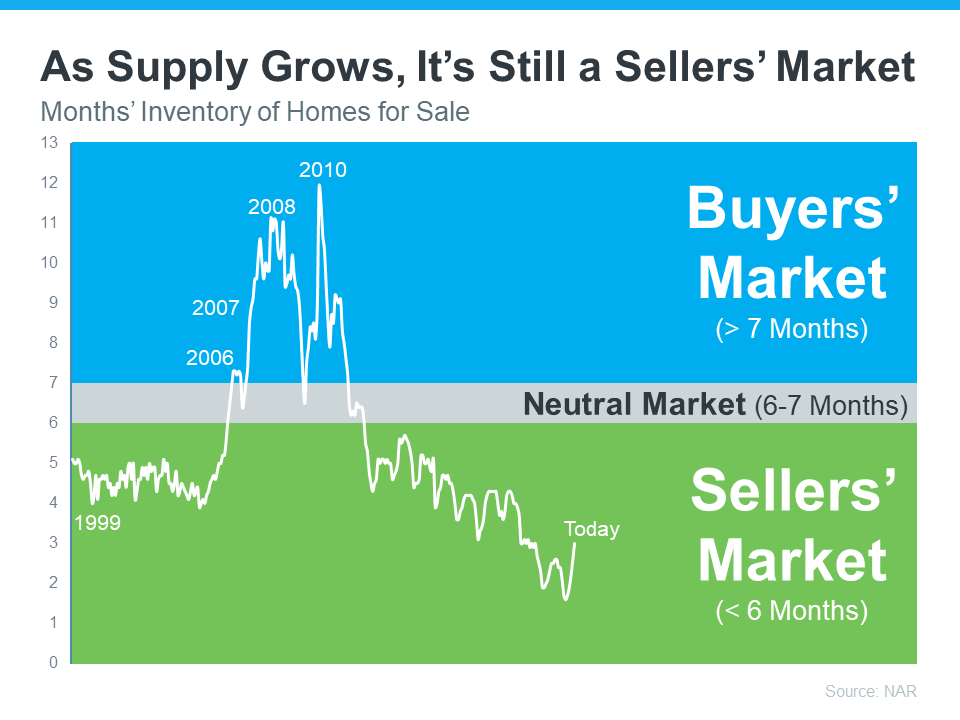

1. Should I Wait To Sell?

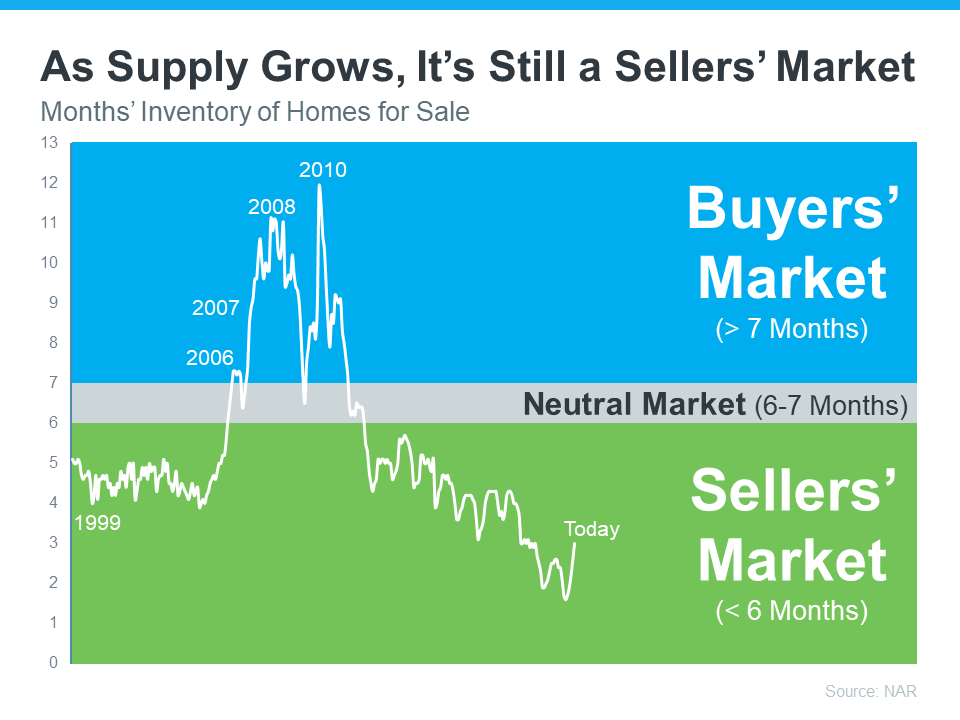

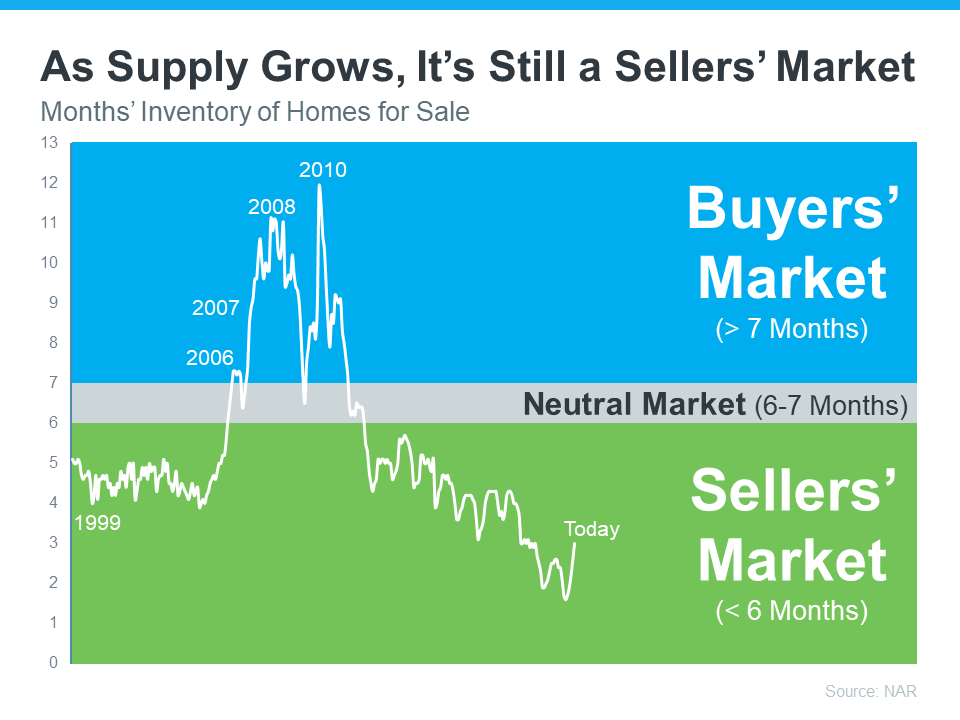

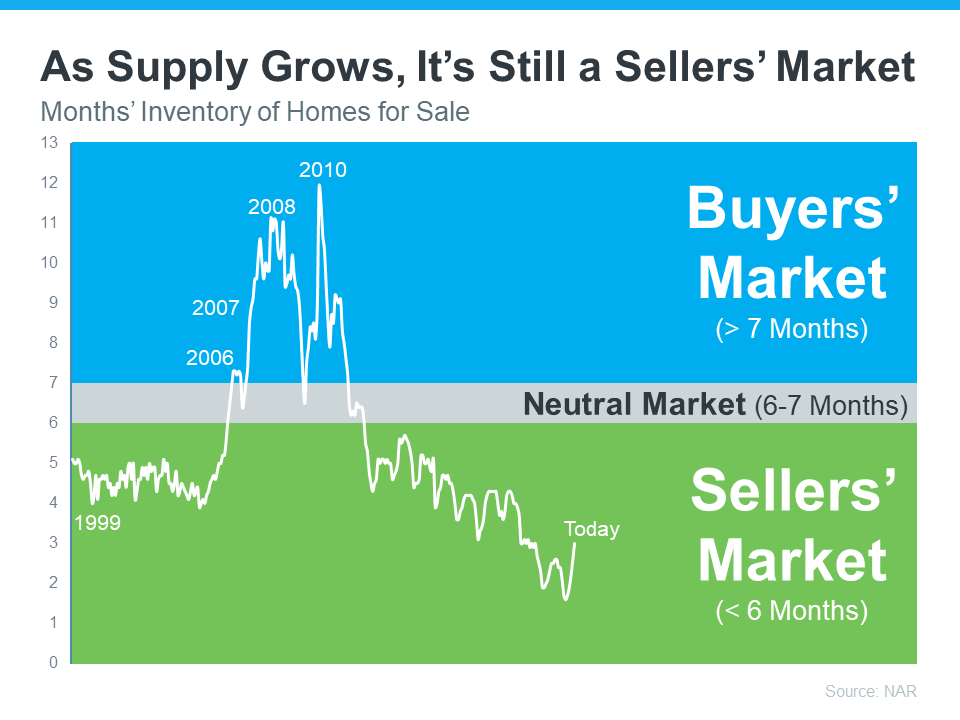

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

If you’re thinking about moving, it’s important to know what’s happening in the housing market. Here’s an update on the supply of homes currently for sale. Whether you’re buying or selling, the number of homes in your area is something you should pay attention to.

In the housing market, there are regular patterns that happen every year, called seasonality. Spring is the peak homebuying season and also when the most homes are typically listed for sale (homes coming onto the market are known in the industry as new listings). In the second half of each year, the number of new listings typically decreases as the pace of sales slows down.

The graph below uses data from Realtor.com to provide a visual of this seasonality. It shows how this year (the black line) is breaking from the norm (see graph below):

Looking at this graph, three things become clear:

- 2017-2019 (the blue and gray lines) follow the same general pattern. These years were very typical in the housing market and their lines on the graph show normal, seasonal trends.

- Starting in 2020, the data broke from the normal trend. The big drop down in 2020 (the orange line) signals when the pandemic hit and many sellers paused their plans to move. 2021 (the green line) and 2022 (the red line) follow the normal trend a bit more, but still are abnormal in their own ways.

- This year (the black line) is truly unique. The steep drop off in new listings that usually occurs this time of year hasn’t happened. If 2023 followed the norm, the line representing this year would look more like the dotted black line. Instead, what’s happening is the number of new listings is stabilizing. And, there are even more new listings coming to the market this year compared to the same time last year.

What Does This Mean for You?

- For buyers, new listings stabilizing is a positive sign. It means you have a more steady stream of options coming onto the market and more choices for your next home than you would have at the same time last year. This opens up possibilities and allows you to explore a variety of homes that suit your needs.

- For sellers, while new listings are breaking seasonal norms, inventory is still well below where it was before the pandemic. If you look again at the graph, you’ll see the black line for this year is still lower than normal, meaning inventory isn’t going up dramatically and prices aren’t heading for a crash. And with less competition from other sellers than you’d see in a more typical year, your house has a better chance to be in the spotlight and attract eager buyers.

Bottom Line

Whether you’re on the hunt for your next home or thinking of selling, now might just be the perfect time to make your move. If you have questions or concerns about the availability of homes in our local area, let’s connect.

-

Where Will You Go After You Sell Your House?

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

![Where Will You Go After You Sell Your House? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2023/03/02130948/Where-Will-You-Go-After-You-Sell-Your-House-MEM-1046x2045.png)

Some Highlights

- If you’re thinking of selling your house, be sure to explore all the options you have for your next home.

- Both newly built homes and existing homes offer plenty of unique benefits.

- If you have questions about the options in our area, let’s discuss what’s available and what’s right for you.

-

Checklist for Selling Your House This Spring

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

![Checklist for Selling Your House This Spring [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2023/02/22133548/Checklist-For-Selling-This-Spring-MEM-1046x1974.png)

Some Highlights

- As you get ready to sell your house, there are specific things you can add to your to-do list.

- These include decluttering, taking down personal photos and items, and power washing outdoor surfaces.

- Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

-

Should You Rent Your House or Sell It?

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative to a hotel, and they’re an investment that’s gained popularity in recent years. According to a Harris Poll survey, 28% of homeowners have considered using a rental service to temporarily rent out their home for additional income.

Owning a short-term rental can be a tempting idea, but you may find the reality of being responsible for one difficult to take on. Here are some of the challenges you could face if you rent out your house instead of selling it.

A Short-Term Rental Comes with Responsibilities

Successfully owning and renting a house takes work. Think through your ability to make that commitment, especially if you plan to use a platform that advertises your rental listing. Most of them have specific requirements hosts have to meet, and it takes a lot of work. A recent article from Bankrate explains:

“Managing a rental property can be time-consuming and challenging. Are you handy and able to make some repairs yourself? If not, do you have a network of affordable contractors you can reach out to in a pinch? Consider whether you want to take on the added responsibility of being a landlord, which means screening tenants and fielding issues, among other responsibilities, or paying for a third party to take care of things instead.”

Not only is there the upfront time and cost of owning a short-term rental, but there are also risks that could come up for you down the road. Investopedia warns:

“Risks of hosting include renting your place to rude guests, theft or damaged property, complaints from neighbors, and potential regulatory violations depending on your location.”

There’s a lot to consider before taking the leap and converting your house into a short-term rental. If you aren’t ready for the work it takes, it could be wiser to sell instead.

Your House May Not Be Ideal for Your Rental Goals

Not every house ends up being a profitable short-term rental either. One of the biggest factors is where your home is located. The less likely your neighborhood is to be a travel destination, the fewer requests you should expect from potential renters—and that impacts your bottom line. An article from the National Association of Realtors (NAR) advises:

“When it comes to the viability of profitable STRs . . . consider factors like location, amenities, and whether the property is appealing. Most people seek STRs in locations where they vacation, so proximity to attractions is important. Likewise, the property should cater to a variety of travelers.”

It’s smart to do your homework and learn how much rentals in your area go for, how much business they get throughout the year, and how this compares to your goals.

Bottom Line

Converting your home into a short-term rental isn’t a decision you should make without doing your research. To decide if selling your house is a better alternative, let’s connect today.

-

Why It Makes Sense To Move Before Spring

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

Spring is usually the busiest season in the housing market. Many buyers wait until then to make their move, believing it’s the best time to find a home. However, that isn’t always the case when you factor in the competition you could face with other buyers at that time of year. If you’re ready to buy a home, here’s why it makes sense to move before the spring market picks up.

Spring Should Bring a Wave of Buyers to the Market

In most years, the housing market goes through predictable seasonal trends in activity. Winter is typically a quiet point in the year, while spring sees a surge of buyers begin their search. And experts project that this year will be no exception.

Right now, buyer demand is low due to a combination of normal seasonal trends and a reaction to last year’s rise in mortgage rates. But rates have started to come down since last November, which has more and more potential buyers planning to jump into the market. That means right now is a sweet spot if you’re in a good position to buy, before more buyers reappear. Affordability is beginning to improve, but demand is still low — for now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), shares:

“. . . expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.”

If you’re ready to buy a home, right now is the best time to do so before your competition grows and more buyers enter the market.

Today’s Sellers Are Motivated

Low demand from buyers often means sellers are more motivated to work with you, and that can set you up to buy a home on your terms. In fact, sellers have been more willing to negotiate this winter because there are fewer buyers in the market. According to a recent article from Forbes:

“. . . sellers gave concessions to buyers in 41.9% of home sales in the fourth quarter of last year.”

But keep in mind, the advantages buyers have this winter won’t last forever. The competition you face could be greater if you wait until spring to make a move, and increased buyer demand means sellers will have less motivation to negotiate with you. Be sure to work with a trusted real estate professional to learn what you can expect in your local market right now.

Bottom Line

If you’re in a good position to make a move, it may make sense to move before spring. Working with your team of expert real estate advisors is the best way to learn about the current market and what it means for you. Let’s connect today to determine the best plan to achieve your homebuying goals.

-

Where Will You Go If You Sell? You Have Options.

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

There are plenty of good reasons you might be ready to move. No matter your motivations, before you list your current house, you need to consider where you’ll go next.

In today’s market, it makes sense to explore all your options. That includes both homes that have been lived in before as well as newly built ones. To help you decide which is right for you, let’s compare the benefits of each. Regardless of which option you choose to explore, working with a trusted real estate professional throughout the process is essential.

The Benefits of Newly Built Homes

First, let’s look at the benefits of purchasing a newly constructed home. With a brand-new house, you’ll be able to:

1. Build your dream home

If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more. Bankrate puts it like this:

“Building means customizing. . . . instead of wishing your home had a certain kind of flooring, a sunroom or some other special amenity, you’ll be able to tailor the property to your exact needs. You also won’t be limited to a specific location or neighborhood.”

2. Take advantage of builder concessions

In today’s market, a lot of home builders are working hard to sell their current inventory before they add more to their mix. That means many of them are offering concessions and are more willing to negotiate with buyers. That could work to your advantage in the process.

3. Minimize home repairs

Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little improvement projects to tackle. As realtor.com says:

“. . . if something goes wrong with your new home, not only are there likely some manufacturer warranties in place, but many builders also include additional home warranties . . .”

4. Take advantage of energy efficiency

When building a home, you can choose brand-new, energy-efficient options to help lower your utility costs, protect the environment, and reduce your carbon footprint.

The Benefits of Existing Homes

Now, let’s compare those to the perks that come with buying an existing home. With a pre-existing home, you can:

1. Explore a wider variety of home styles and floorplans

With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

2. Appreciate that lived-in charm

The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home.

3. Join an established neighborhood

Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit. Plus, they have more developed landscaping and trees, which can give you additional privacy and curb appeal.

4. Move in faster

If you have a short timeframe to move or you just don’t want the process to take several months while your home is under construction, buying an existing home might make sense for you. U.S. News explains:

“When you’re choosing a home, existing or new, you should also consider how long it might take to move into that home. Just because you have a contract doesn’t mean that your new home will be completed (or even started) at the time you agree to the purchase. It can be a struggle waiting for the walls to go up as you wonder what your home will become.”

When thinking about where you’ll go after you sell your house, remember your options. As you start your search, think about what’s most important to you. By working with a trusted real estate agent, you can be confident you’re making the most educated, informed decision.

Bottom Line

If you have questions about the options in our area, let’s discuss what’s available and what’s right for you, so you’re ready to make your next move with confidence.

-

Is It Time To Sell Your Second Home?

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

During the pandemic, second homes became popular because of the rise in work-from-home flexibility. That’s because owning a second home, especially in the luxury market, allowed those homeowners to spend more time in their favorite places or with different home features. Keep in mind, a luxury home isn’t only defined by price. In a recent article, Investopedia shares additional factors that push a home into this category: location, such as a home on the water or in a desirable city, and features, the things that make the home itself feel luxurious.

A recent report from the Institute for Luxury Home Marketing (ILHM) explains just how much remote work impacted the demand for second and luxury homes:

“The unprecedented ten-fold increase towards remote work since the pandemic is an historic development that will continue to fuel second home demand for many years to come.”

But what if you bought a second home that you no longer use? If you’re now shifting back into the office or are seeing your priorities and needs change, you may find you’re not utilizing your second home as much. If so, it may be time to sell it.

And if you own what’s considered a luxury home, buyer demand for it may be even greater. In another report, the Institute for Luxury Home Marketing explains:

“. . . the last few years have left their legacy for the luxury market. While it might only represent a small percentage of the overall real estate market, luxury homeownership’s influence is growing. Not only has the purchase of homes valued over $1 million (a figure considered by the National Association of Realtors to be a benchmark for luxury) tripled from 2.6% to 6.5% since 2018, but demand for multiple luxury properties has soared over the last two years.

This phenomenal increase has been driven by a growing affluent demographic who consider owning a luxury property a necessity in their asset portfolio. All indications are that this trend is here to stay, albeit that demand is set to return to a more sustainable level.”

If you own a luxury second home that isn’t being used as much anymore, now’s the time to sell. There are still buyers in the market who are looking for a home like yours today.

Bottom Line

Let’s connect to explore the benefits of selling your second home this year.

-

What Past Recessions Tell Us About the Housing Market

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

It doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than explaining them each in depth, let’s lean on the experts and what history tells us to see what could lie ahead. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Two-in-three economists are forecasting a recession in 2023 . . .”

As talk about a potential recession grows, you may be wondering what a recession could mean for the housing market. Here’s a look at the historical data to show what happened in real estate during previous recessions to help prove why you shouldn’t be afraid of what a recession could mean for the housing market today.

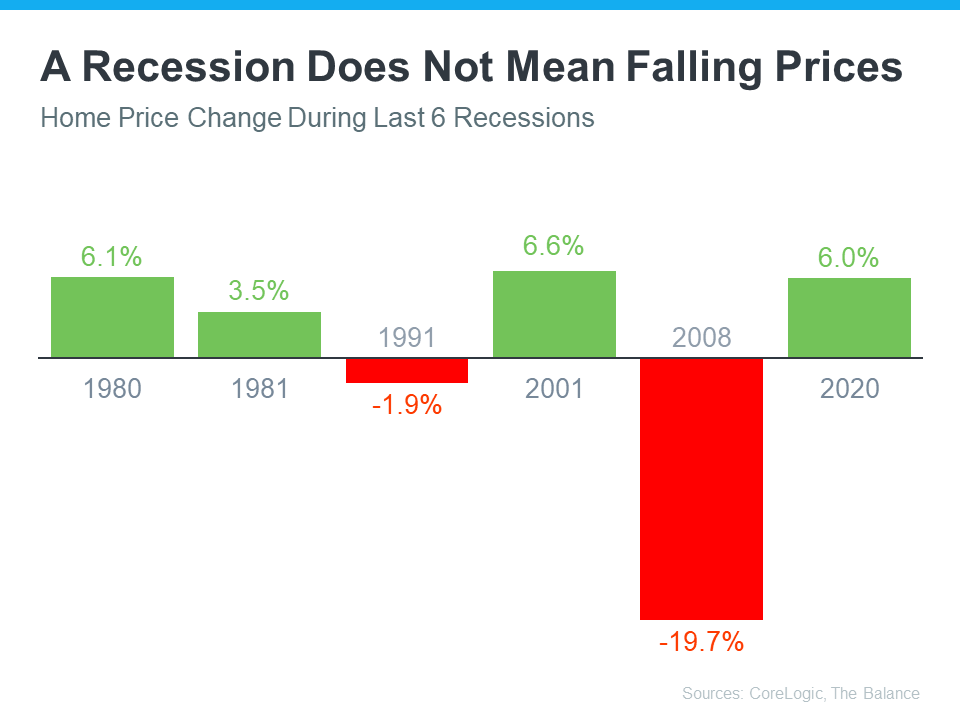

A Recession Doesn’t Mean Falling Home Prices

To show that home prices don’t fall every time there’s a recession, it helps to turn to historical data. As the graph below illustrates, looking at recessions going all the way back to 1980, home prices appreciated in four of the last six of them. So historically, when the economy slows down, it doesn’t mean home values will always fall.

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and think another recession would be a repeat of what happened to housing then. But today’s housing market isn’t about to crash because the fundamentals of the market are different than they were in 2008. According to experts, home prices will vary by market and may go up or down depending on the local area. But the average of their 2023 forecasts shows prices will net neutral nationwide, not fall drastically like they did in 2008.

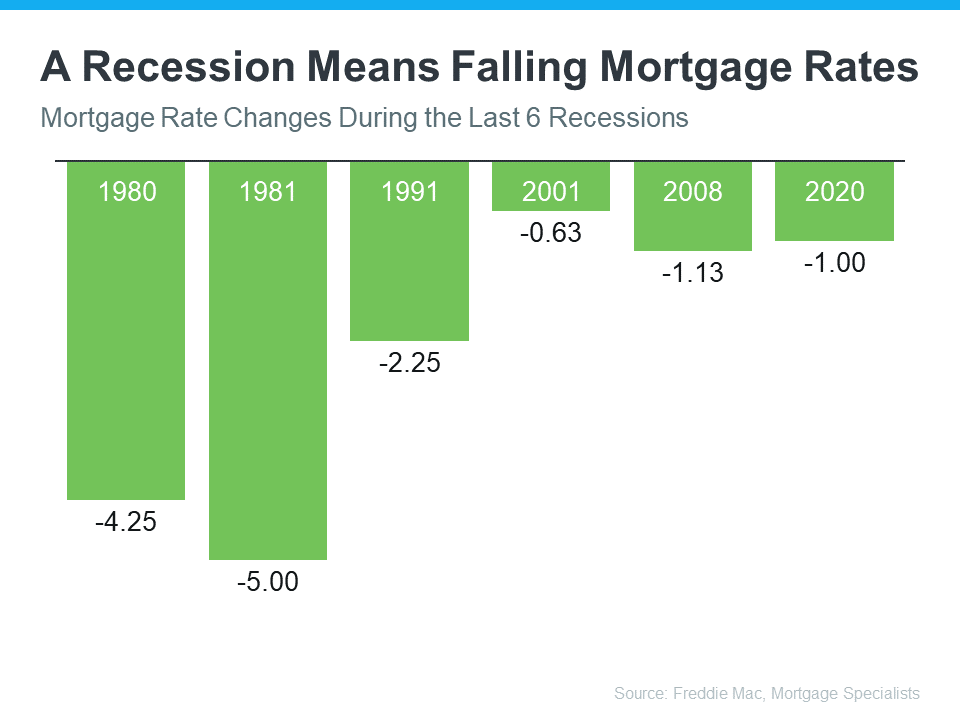

A Recession Means Falling Mortgage Rates

Research also helps paint the picture of how a recession could impact the cost of financing a home. As the graph below shows, historically, each time the economy slowed down, mortgage rates decreased.

Fortune explains mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

In 2023, market experts say mortgage rates will likely stabilize below the peak we saw last year. That’s because mortgage rates tend to respond to inflation. And early signs show inflation is starting to cool. If inflation continues to ease, rates may fall a bit more, but the days of 3% are likely behind us.

The big takeaway is you don’t need to fear the word recession when it comes to housing. In fact, experts say a recession would be mild and housing would play a key role in a quick economic rebound. As the 2022 CEO Outlook from KPMG, says:

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, with more than half expecting it to be mild and short.”

Bottom Line

While history doesn’t always repeat itself, we can learn from the past. According to historical data, in most recessions, home values have appreciated and mortgage rates have declined.

If you’re thinking about buying or selling a home this year, let’s connect so you have expert advice on what’s happening in the housing market and what that means for your homeownership goals.

-

Today’s Housing Market Is Nothing Like 15 Years Ago

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

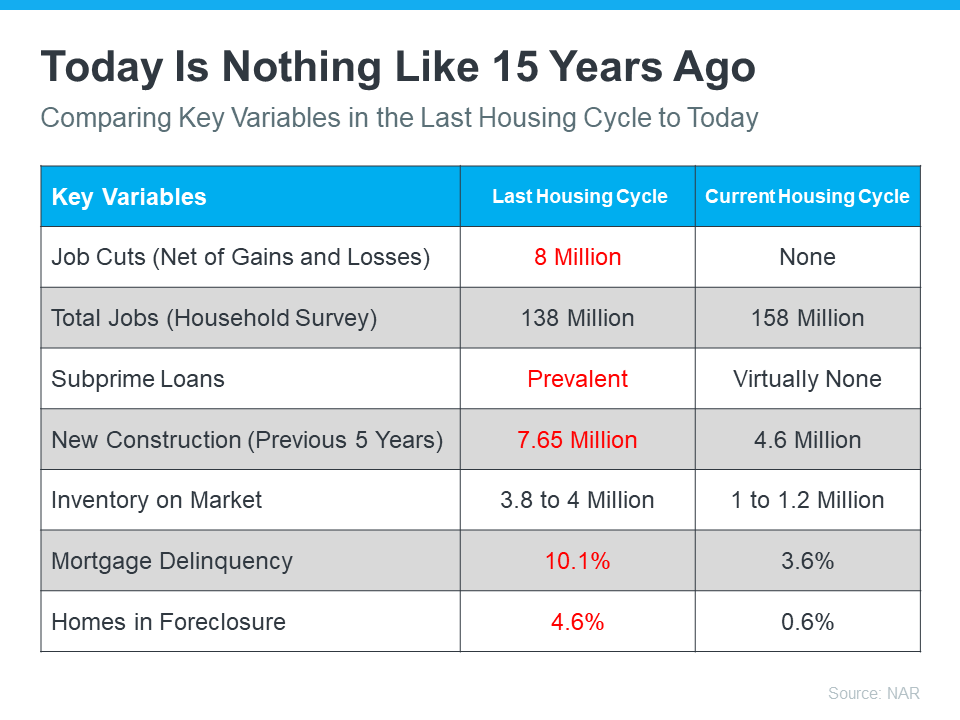

There’s no doubt today’s housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make comparisons to the 2008 housing crisis. While there may be a few similarities, when looking at key variables now compared to the last housing cycle, there are significant differences.

In the latest Real Estate Forecast Summit, Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), drew the comparisons below between today’s housing market and the previous cycle:

Looking at the facts, it’s clear: today is very different than the housing market of 15 years ago.

There’s Opportunity in Real Estate Today

And in today’s market, with inventory rising and less competition from other buyers, there’s opportunity right now. According to David Stevens, former Assistant Secretary of Housing:

“So be advised…this may be the one and only window for the next few years to get into a buyer’s market. And remember…as the Federal Reserve data shows…home prices only go up and always recover from recessions no matter how mild or severe. Long term homeowners should view this market…right now…as a unique buying opportunity.”

Bottom Line

Today’s housing market is nothing like the real estate market 15 years ago. If you’re a buyer right now, this may be the chance you’ve been waiting for.

-

Avoid the Rental Trap in 2023

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

If you’re a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true costs of renting moving forward.

In the past year, both current renters and new renters have seen their rent go up based on information from realtor.com:

“Three out of four renters (74.2%) who have moved in the past 12 months reported seeing their rent increase. The strain from recent rent hikes isn’t exclusive to renters who have recently moved. Nearly two-thirds of renters (63.2%) who have lived in their current rental between 12 and 24 months, and likely renewed their lease, have also reported increases in their rent.”

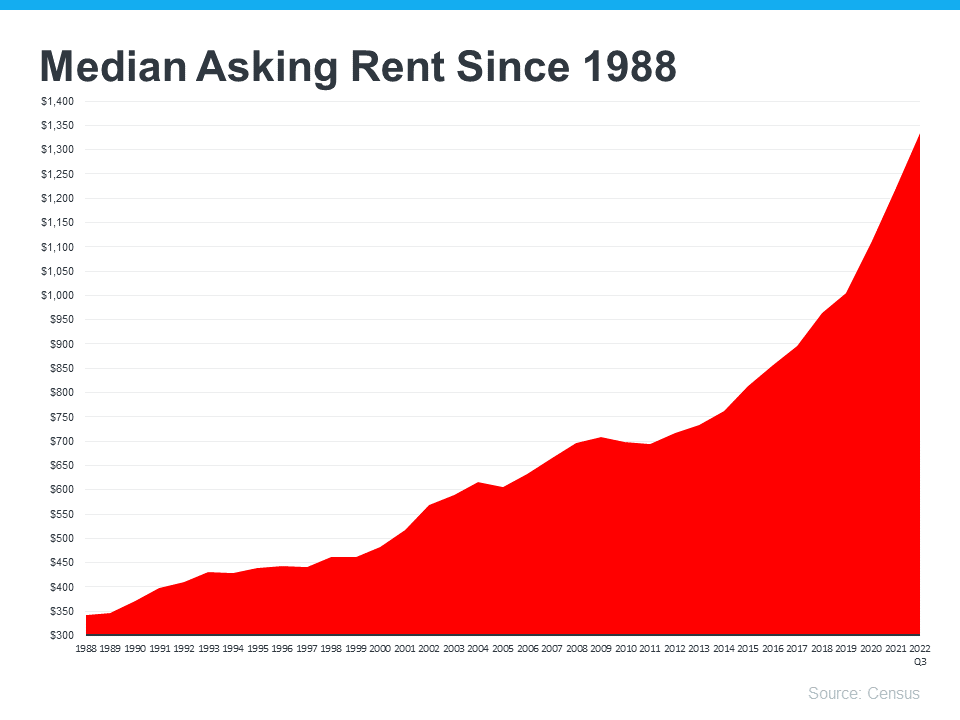

And if you look back at historical data, that shouldn’t come as surprise. That’s because, according to the Census, rents have been rising fairly consistently since 1988 (see graph below):

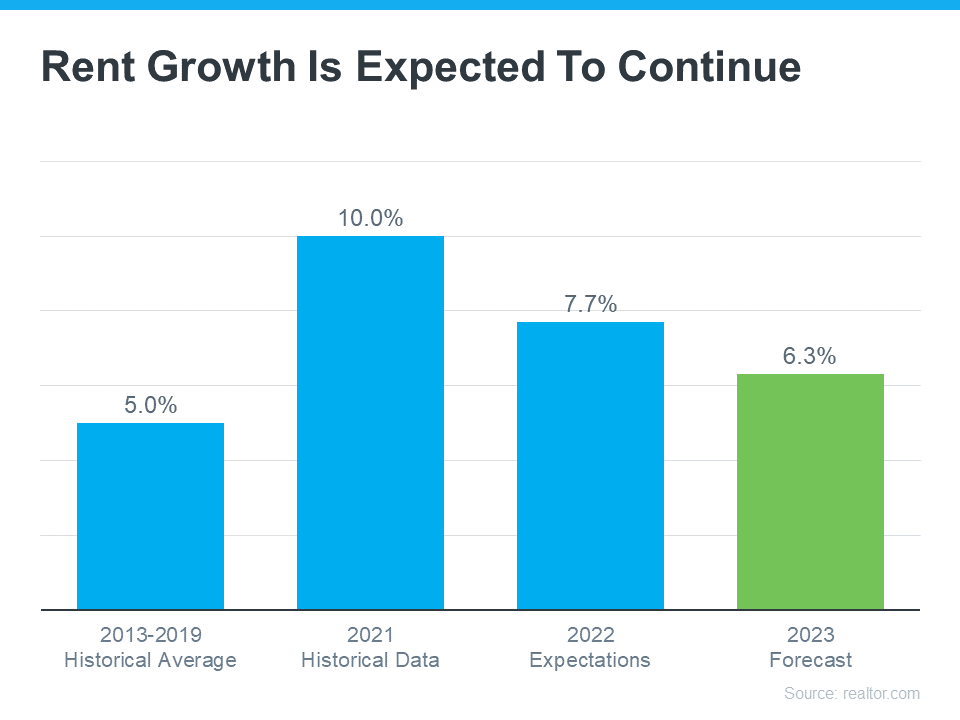

So, if you’re considering renting as an option in 2023, it’s worth weighing whether this trend is likely to continue. The 2023 Housing Forecast from realtor.com expects rents will keep climbing (see graph below):

That forecast projects rents will increase by 6.3% in the year ahead (shown in green). When compared to the blue bars in the graph, it’s clear that the 2023 projection doesn’t call for an increase as drastic as the ones renters have seen over the past two years, but it’s still above the historical average for rent hikes between 2013-2019.

That means, if you’re planning to rent again this year and you’ve not yet renewed your lease, you may pay more when you do.

Homeownership Provides an Alternative to Rising Rents

These rising costs may make you reconsider what other alternatives you have. If you’re looking for more stability, it could be time to prioritize homeownership. One of the many benefits of owning your own home is it provides a stable monthly cost that you can lock in for the duration of your loan. As Freddie Mac says:

“Monthly rent payments may increase over time, but a fixed-rate mortgage will ensure that you’re paying the same amount each month. With a fixed-rate mortgage, your interest rate is locked in for the life of loan. Steady payments allow you to budget wisely and make plans for the future.”

If you’re planning to make a move this year, locking in your monthly housing costs for the duration of your loan can be a major benefit. You’ll avoid wondering if you’ll need to adjust your budget to account for annual increases like you would if you left your housing payment up to your landlord and their renewal cycle.

Homeowners also enjoy the added benefit of home equity, which has grown substantially. In fact, the latest Homeowner Equity Insight report from CoreLogic shows the average homeowner gained $34,300 in equity over the last 12 months. As a renter, your rent payment only covers the cost of your dwelling. When you pay your mortgage on a house, you grow your wealth through the forced savings that is your home equity.

Bottom Line

If you’re thinking of renting this year, it’s important to keep in mind the true costs you’ll face. Let’s chat to see how you can begin your journey to homeownership today.

-

3 Best Practices for Selling Your House This Year

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

A new year brings with it the opportunity for new experiences. If that resonates with you because you’re considering making a move, you’re likely juggling a mix of excitement over your next home and a sense of attachment to your current one.

A great way to ease some of those emotions and ensure you’re feeling confident in your decision is to keep these three best practices in mind.

1. Price Your Home Right

The housing market shifted in 2022 as mortgage rates rose, buyer demand eased, and the number of homes for sale grew. As a seller, you’ll want to recognize things are different now and price your house appropriately based on where the market is today. Greg McBride, Chief Financial Analyst at Bankrate, explains:

“Price your home realistically. This isn’t the housing market of April or May, so buyer traffic will be substantially slower, but appropriately priced homes are still selling quickly.”

If you price your house too high, you run the risk of deterring buyers. And if you go too low, you’re leaving money on the table. An experienced real estate agent can help determine what your ideal asking price should be.

2. Keep Your Emotions in Check

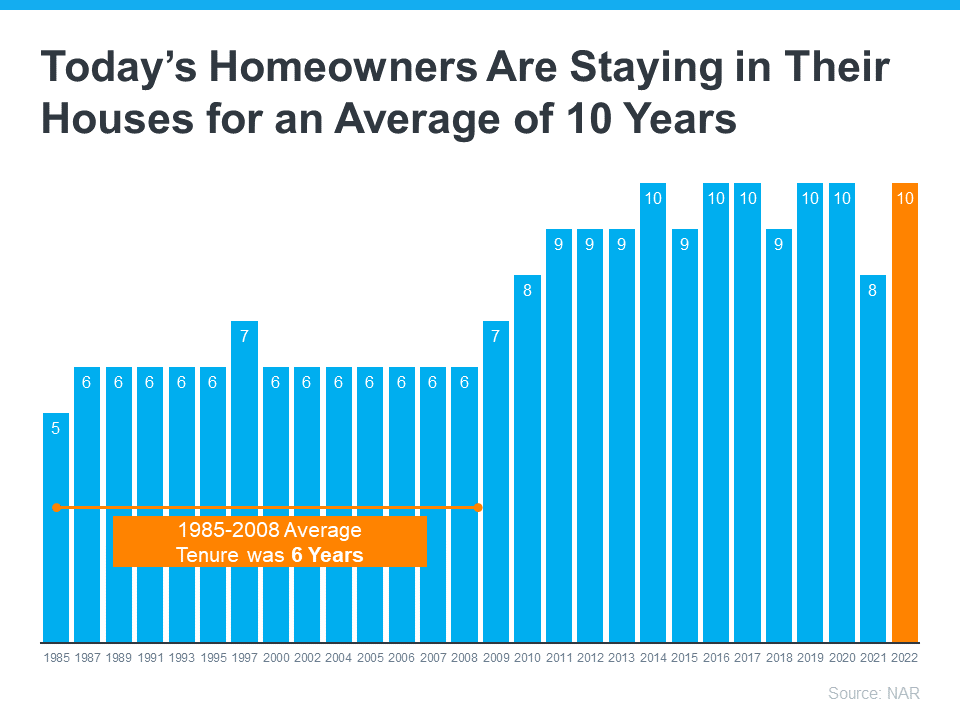

Today, homeowners are living in their houses longer. According to the National Association of Realtors (NAR), since 1985, the average time a homeowner has owned their home has increased from 5 to 10 years (see graph below):

This is several years longer than what used to be the historical norm. The side effect, however, is when you stay in one place for so long, you may get even more emotionally attached to your space. If it’s the first home you bought or the house where your loved ones grew up, it very likely means something extra special to you. Every room has memories, and it’s hard to detach from the sentimental value.

For some homeowners, that makes it even harder to negotiate and separate the emotional value of the house from fair market price. That’s why you need a real estate professional to help you with the negotiations along the way.

3. Stage Your Home Properly

While you may love your decor and how you’ve customized your home over the years, not all buyers will feel the same way about your design. That’s why it’s so important to make sure you focus on your home’s first impression so it appeals to as many buyers as possible. As NAR says:

“Staging is the art of preparing a home to appeal to the greatest number of potential buyers in your market. The right arrangements can move you into a higher price-point and help buyers fall in love the moment they walk through the door.”

Buyers want to envision themselves in the space so it truly feels like it could be their own. They need to see themselves inside with their furniture and keepsakes – not your pictures and decorations. A real estate professional can help you with tips to get your house ready to sell.

Bottom Line

If you’re considering selling your house, let’s connect so you have the help you need to navigate through the process while prioritizing these best practices.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.